Disclaimer

The views expressed in this publication are those of invited contributors and not necessarily those of the Institute and Faculty of Actuaries. The Institute and Faculty of Actuaries does not endorse any of the views stated, nor any claims or representations made in this publication, and accepts no responsibility or liability to any person for loss or damage suffered as a consequence of their placing reliance upon any view, claim or representation made in this publication. The information and expressions of opinion contained in this publication are not intended to be a comprehensive study, nor to provide actuarial advice or advice of any nature, and should not be treated as a substitute for specific advice concerning individual situations. On no account may any part of this publication be reproduced without the written permission of the Institute and Faculty of Actuaries.

Section 1: Introduction

1.1. The Context

This Working Party and its paper were born out of the Running Off Mature Schemes Working Party. It recommended that the actuarial profession sponsors research the various facets of run-off to consider when assessing the Target End-State (TES) options for UK-defined benefit pension schemes (“schemes”).

This paper’s primary purpose is to assist actuaries in advising on end-state options. This will support the delivery of robust advice and improved outcomes for members and employers. The Working Party includes practitioners from outside of the actuarial profession, reflecting a topic that requires collaboration across multiple specialist areas.

1.2. Some Key Conclusions

We define the TES as the target stable state for a scheme such that when it achieves that state (providing it maintains it) member benefit entitlements will be met in full, with a high degree of certainty.

It will be clear from the length of this paper that the question of TES for schemes is a complex topic, which merits a thorough discussion. Having spent a considerable amount of time wrestling with these questions, a few key conclusions stood out to us.

1.3. Conclusions for Actuaries

-

1. The role of the actuary should change: Rather than be a technical specialist, actuaries have the opportunity to move into a strategic advisory role, which will be needed to help clients properly. Many actuaries already have. Broad generalist skills are vital, and deep, technical precision is replaced by more agile, rounded thinking: the ability to facilitate multi-disciplinary collaboration, quickly weigh up options, and play out alternative scenarios. New skills include:

• Strategist

• Contingency planner

• Decision-making coach

• Cross-disciplinary facilitator (bringing the strands together).

2. A new paradigm is needed, focused on member outcomes: When we considered how to decide between the different TES (Section 8) it was clear that standard industry metrics and funding levels were not good enough. An approach that focuses on the member outcome is an essential tool in equipping clients to make these tricky decisions.

3. The actuarial valuation needs to be re-positioned: It has become almost a cliché in the industry to talk about “journey plans” to get to the TES, but the analogy is a good one for many reasons. The actuarial valuation has an evolving role to play as a key mile-marker in the context of a longer journey rather than itself being the centrepiece of the decision-making framework.

1.4. Conclusions for the Profession and Regulators

-

1. Levels of accuracy in the understanding of the scheme liabilities: No matter which TES trustees might choose, having a clear and legally signed-off understanding of the membership’s legal entitlement to benefits and fully cleansed data should become the norm. This level of accuracy is a necessary foundation upon which member outcomes and the pursuit of the TES rest.

-

2. Look to stressed schemes for examples: A strong employer today can become stressed in just a few years. With contingency planning – a core thread running through this paper – we found that looking at some of the edge cases in the current world was helpful to give actuaries a handle on exploring possible scenarios. More sharing of ideas and experiences in these difficult cases would also benefit everyone.

-

3. Solutions need to downward scale: The defined benefit landscape in the UK is skewed towards a very large number of small schemes that have vastly different capabilities for what they can achieve, and the options based on their size. All our considerations need to be capable of proportionate application to smaller schemes.

-

4. Dynamic discount rates: The funding model once a scheme reaches a low-dependency TES has not been subject to the level of research and innovation that other areas have, and this needs to change if it is to become a credible TES, particularly for some of the larger schemes. Investment and funding policies ought to work together to deliver the best member outcomes. In particular, the industry should develop methodologies for variable discount rates that, where appropriate, can be used in a low-dependency TES to better align funding measures with financing.

1.5. How to Use this Document/Why is it Written this Way

Most of this paper is dedicated to exploring the details of each of the TES options in order to equip actuaries with enough of a working knowledge of each option to approach conversations on it (Sections 4, 5 and 6 go into detail on the different TES options and Section 8 provides help on how to decide).

However, there are three areas that became clear above the different options and are common themes that occur throughout these discussions, which we have set out at the start:

-

1. The role of the trustees (Section 2): In our explorations of the different options, we kept coming back to some fundamental questions facing trustees. What are their core duties and obligations? In this section, we provide a primer on the blend of trust and pensions law in which trustees operate, particularly as it pertains to selecting a TES and delivering the benefits.

-

2. Sponsor covenant (Section 3): This sits at the heart of every discussion on TES and is a key aspect that differs substantially from one scheme to the next. The core commonality across all the discussions of TES options was the impact of the employer’s covenant and changes in the covenant strength. While trustees will typically have specialist advisers for this, actuaries need to have a sound working knowledge of the interplay of employer covenant with other considerations, to advise effectively in this area.

-

3. How to choose – using member outcome models (Section 7): It became clear to us that a paper like this would be incomplete without a clear framework for helping actuaries support their clients in taking the important decisions around the TES. However, many of the classic frameworks around funding, volatility or value-at-risk were lacking as they either failed to incorporate employer covenant adequately or lacked the appropriate view of timescale. We conclude that models that attempt to directly model member outcomes (which are starting to emerge in the industry) are an essential tool in helping clients make this decision. As we discuss each TES, therefore, it is important to view it through the lens of member outcomes, as well as provide some background on how to set up a member outcomes-driven decision frame.

Section 2: The Role of the Trustees, the Employer and the Actuary

2.1. Introduction

The corporate sector defined benefits pensions industry in the UK is a significant driver of the economy. Pension Protection Fund (2020b) states that the sector has assets of £1,701 billion on 31 March 2020, backing liabilities on a buyout basis of £2,369 billion, representing circa 5,300 schemes and covering just under 10 million members. These figures are comparable to the UK’s annual gross domestic product in scale. Ultimately, corporate sector schemes will support millions of individuals, in many cases providing a significant source of financial security over the next 50 years or more.

When considering the TES and the journey plan to deliver it, at the centre of all decisions are the legal duties and responsibilities of the parties concerned.

This section considers the role of the trustees and the employer, the two parties that are generally assigned various duties by a scheme’s governing documentation, together with the role of the actuary, who is a key adviser. Of course, other advisers are also important but only the actuary is covered here, given the context of this paper. The role of other advisers can nevertheless be inferred from narrative throughout this paper.

Whilst much is made of the asset side of achieving a TES, the starting position from a legal and holistic perspective is the actual benefit payments a scheme is committed to make. Too little attention is often paid to the exact legal entitlements of the beneficiaries of schemes.

Detailed benefit reviews are nearly certain to find overpayments as often as underpayments – the earlier these issues are found, the lower the cost of correction, as well as promoting a more robust TES. This section therefore devotes some detail to this topic.

Also covered in this section are other aspects key to the TES discussion, such as whether trustees are obliged to target a buyout or can instead gravitate to a preferred alternative.

2.2. Summary of the Pensions Legal Landscape

Pensions law is a complex mix of:

-

1. Trust law principles developed over centuries

-

2. The rules of each scheme

-

3. Statutory provisions and regulation

-

4. Other overriding court case judgments and precedents.

As well as pensions law itself, there are myriad other overlapping legal areas such as company, commercial, investment, financial services, data protection and disputes law.

Non-compliance with the generality of pensions law can result in liability to the trustees for losses suffered as a result. Breach of statutory provisions can result in fines, civil penalties and criminal prosecution.

Pensions legislation has been clarified by codes of practice and guidance developed by TPR. TPR has the power to issue codes of practice relating to most pension legislation enacted since 1993 and in some areas, it is obliged to issue these. The codes explain key elements of pensions legislation and give examples of TPR’s expectations.

Compliance with codes of practice (where TPR strays from source legislation) and guidance is not compulsory and whilst an important part of the pensions landscape, it is fundamentally not pensions law. But where trustees or an employer are subject to a legal proceeding, failure to comply with codes of practice may be considered. Thus, parties that do not comply with codes fully should be able to properly explain the reasons for that non-compliance.

Until recently there has been little guidance from TPR in terms of what a scheme’s TES should be or how a scheme should progress to its TES. Since 2004, the focus from a scheme financing perspective has primarily been on the triennial actuarial valuation cycle for determining funding and deficit recovery plans.

In March 2020, the position changed significantly with the publication of the TPR’s first consultation on a new funding code of practice to implement the measures introduced in the Pension Schemes Bill 2020Footnote 1 laid in Parliament in January 2020.

The Bill will introduce a requirement for trustees to set combined, or “integrated”, funding and investment strategies that essentially take the form of a long-term journey plan, which TPR describes as the “long-term objective” (LTO). TPR’s expectation is that by the time a scheme is significantly mature, the LTO will ensure it is fully funded on a so-called “low dependency” basis, which it describes as a state where the scheme should have high probability of being able to meet all benefits in full without significant further financial resources being required from the employer. Further details on the specifics of the new funding code are set out in the appendix. However, for the purposes of this paper, the key point is that all trustees will, for the first time, be obliged to set a LTO and also have a plan for how they will get there.

We have intentionally used the phrase TES rather than LTO in this Paper. Although it will be a significant step forward for all schemes to have an LTO in line with the proposals set out by The Pension Regulator (2020a), a key thrust in our paper is that the target end position, the TES in our terminology, needs to be articulated in detail and to cover all key facets of a scheme’s operations.

2.3. A Summary of the Legal Duties and the Roles of Trustees

At the base level, the duty of the trustees of all schemes is to pay the actual legal entitlements of all members and their beneficiaries as and when they fall due. Those legal entitlements are primarily expressed in the scheme rules and associated pension laws.

The duties placed on trustees, which are at the heart of all trustee actions and decisions, include the requirement to:

-

• Act in accordance with their legal powers under the scheme’s rules as they apply, as supplemented by statutory requirements

-

• Pay the benefits to which the members and their beneficiaries are legally entitled under the scheme rules and pensions law

-

• Act in the best interests of all the scheme beneficiaries – this legal principle has developed over centuries and is a feature of almost all pension litigation. It includes a secondary obligation to take account of the employer’s interests dependent on the circumstances and the terms of the scheme rules

-

• Act impartially between members. There is no obligation to treat all members in the same way.

-

• Invest the assets in a manner that is appropriate given the scheme’s circumstances.

Trustees need to remember that they owe impartial duties to all beneficiaries. For example, member-nominated trustees do not represent the interests of the membership group from which they are drawn, and employer-appointed trustees do not represent the employer's interests.

Professional trustees are becoming increasingly common and are expected to have higher levels of knowledge and understanding than non-professional trustees.

Regardless of expertise, trustees of defined benefit schemes are expected to seek appropriate professional advice on all material matters, and legislation specifically requires professional advice to be sought on specific matters.

The focus of pensions law is on the delivery of beneficiaries’ entitlements as written in the scheme rules – this is the primary point and purpose of a scheme. The means through which those entitlements are delivered is important, but it is a secondary matter – the employer’s contribution obligation and the way the assets are invested are each a means by which those entitlements are delivered but they are not the point and purpose of the scheme.

The various duties and expectations of trustees do mean that trustees will generally operate in a relatively risk-averse manner. However, taking an extremely low-risk or no-risk approach to legal issues in isolation can translate to an ultimately higher-cost approach being taken that undermines member security and, as such, should be avoided. An example of this is not using available powers to make a scheme more efficient to insure, such as general actuarial equivalence changes, meaning a scheme takes longer to reach its TES.

2.4. Actuarial Valuations and the Long-term Funding Objective

The Pensions Act 2004 codified the regime under which schemes have operated for over a decade. It prescribes a scheme-specific funding regime governed by triennial actuarial valuations that assess the market value of the assets held against a “prudent” evaluation of the present value of the liabilities. For schemes in deficit, a recovery plan to make good deficit is agreed upon between the company and trustees every 3 years, currently lasting an average of 6.7 years with the 95th percentile at 15.9 years (TPR, 2019a). The triennial valuation process has become a cornerstone of the way schemes are funded.

However, there was nothing in that regime that required trustees to consider and evaluate their TES.

A good deal has changed in the last few years: schemes have, overall, become better funded following a strong tailwind of investment returns, payment of deficit contributions from employers and some other minor factors, such as reductions in longevity assumptions. Schemes are maturing slowly but steadily, meaning that many are shifting into cash flow negative mode. The endpoint has been crystallised and is generally much more tangible.

Overall, this calls for a shift in the approach taken to funding schemes from the perspective of member security: placing the long-term objective of the scheme, in other words, the TES, front and centre in the decision-making agenda (rather than indirectly through the next triennial valuation), and working back from that to determine funding and investment policies.

TPR (2019b) recognises this and explains quite eloquently the increasing focus on target end-state (noting that the terminology of a long-term funding target (LTFT) has since been replaced by the LTO.):

“Paying the promised benefits is the key objective for all schemes. This requires schemes to look ahead and set clear plans for how the objective will be delivered. Good practice … involves trustees and employers agreeing a clear strategy for achieving their long-term goal, which recognises how the balance between investment risk, contributions and covenant support may change over time as the scheme gets better funded and more mature.

Typically, this leads to a long-term funding target (LTFT) being agreed between trustees and employers … We expect all schemes to … set a LTFT consistent with how the trustees and employers expect to deliver the scheme’s ultimate objective, and then be prepared to evidence that their shorter-term investment and funding strategies are aligned with it.”

This approach is expected to be formalised through the Pensions Schemes Bill (2020). It will require trustees to determine their “funding and investment strategy” with the purpose of “ensuring that pensions and other benefits under the scheme can be provided over the long term”. In other words, trustees will, for the first time, be required to articulate their TES and, at a minimum, design the “funding and investment strategy” that will deliver their TES.

2.5. Understanding Benefit Entitlements

Trustees are used to taking measured financial risks. Trustees spend significant time considering investment strategy risks, employer covenant risks and funding risks.

Most trustees are not used to evaluating legal and operational risks. A key area of such risk, when it comes to discussion around the TES, is the possibility of deviation between:

-

1. The actual legal benefit entitlements of members and their beneficiaries; and

-

2. The benefit entitlements actually being paid, or to which it is understood beneficiaries are entitled.

Whilst there are elements of every benefit structure that are not set out in the rules precisely and are bound up in the administrative calculation routines of schemes, those calculations must still be logical and consistent with the rules overall and pensions law.

It is therefore critical to invest time documenting beneficiaries’ actual legal benefit entitlements to avoid issues being discovered at a time when it is highly disruptive (and arguably too late) to resolve them, hence putting the TES and member benefit security at risk.

Intuitively it might be felt that such issues must be the exception rather than the norm but that is not the case. Almost every scheme will have some issues to resolve and in some schemes material issues might be uncovered. In fact, the Pensions Regulator (2020c) states “The PPF’s experience is that scheme benefits are usually incorrect and the necessary work to put them right, more often than not, results in an increase in liabilities”. Often trustee boards do not mandate advisers to fill in the gaps, perhaps because the business case for the advisory spend is less tangible, the issues are felt to be less immediate or the work is thought to be unnecessary. Sometimes the pressure is from the employer who may see this as “looking for problems”. However, in practice, the advisory costs are immaterial in the content of a scheme’s total liabilities.

Without being certain of beneficiaries’ actual entitlements, trustees can never be certain that they have attained the correct TES. Thus, the preparatory data and benefit tasks typically carried out for buyout (see Section 5) should be done by all schemes as part of the work to achieve the TES.

2.6. Must Trustees Target Insurance Buyout?

Quite simply, no.

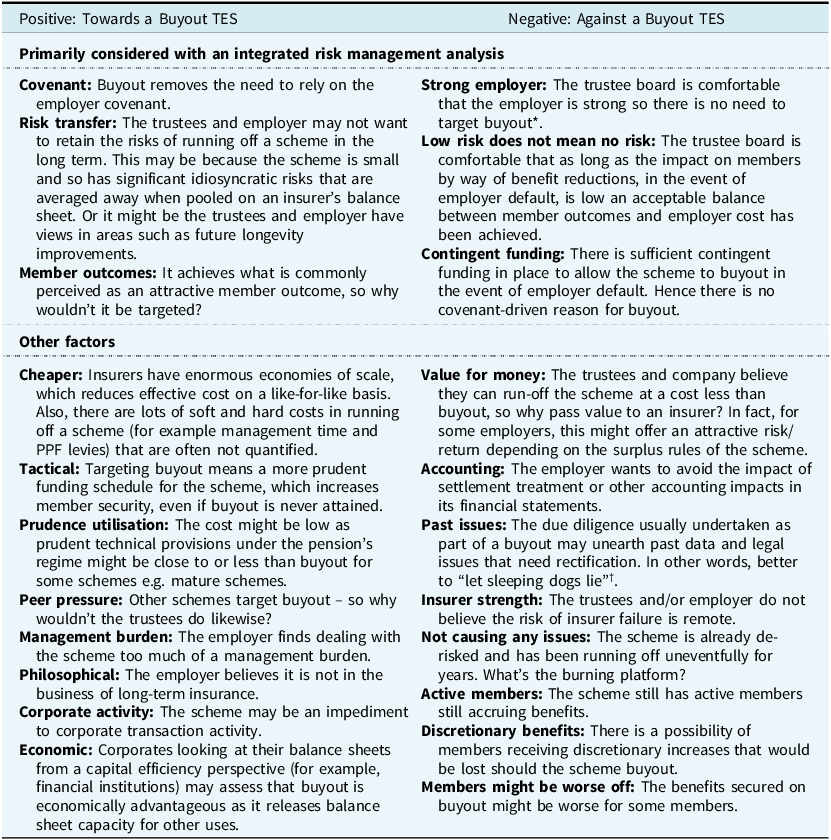

In many circumstances, if trustees are able to afford to purchase buyout they will do so. Why? Because they will assess that this offers the best member outcome as it sensibly minimises the likelihood of beneficiaries not receiving their entitlements. “Sensibly” is an intentional qualification, as the duty of the trustees is not necessarily to eliminate risk, but it would certainly be to manage and reduce risk and uncertainty to a reasonably low level, consistent with their duties as trustees.

At present, within the pension community, there is a lot of promotion surrounding buyout. There is less publicity about trustee boards that have skilfully managed a scheme to a low-dependency status. Hence, in today’s environment, the emphasis is often on “why wouldn’t we buyout?” rather than on “should we buyout?”

A buyout is simply one way of meeting benefit entitlements, but it is not the only way. There is nothing in legislation that says buyouts must be targeted and neither does TPR state that.

Also, many employers may prefer trustees not to aim for buyouts. That may primarily be on financial grounds, but it should also be noted that almost all scheme rules (which in all cases were established by the employer) are designed around schemes running on an ongoing basis, meeting benefits as they fall due from assets, as is most pensions legislation and TPR guidance, with the winding up and buyout provisions being a permissive rather than an automatic provision.

In fact, as the employer in most schemes can replace the trustees (or at least those that are not Member Nominated Trustees) or replace the whole trustee board with a single sole trustee, it means that the employer can, in some cases justifiably, appoint a trustee board that philosophically supports that buyout is not the default TES (subject to that being consistent with being in the best interests of beneficiaries in the specific circumstances).

Given the overriding duty of trustees is to act in the best interests of beneficiaries of the scheme the trustees should have a carefully considered rationale as to why they have selected a particular TES, whether this be buyout or otherwise.

2.7. The Role of the Employer

Employers are also taking an increasing interest in the TES, recognising that their input is central to helping trustees develop a TES that aligns with corporate objectives and associated financial constraints.

Whilst employers of schemes owe different legal duties towards the scheme beneficiaries, they are still obliged to comply with the terms of the scheme rules and pensions law.

Where the employer has powers under the scheme rules, it is obliged to consider the interests of members in making that decision but in most cases, it is also able to take account of its own commercial interests.

Company directors also have legal duties to their other stakeholders, which include shareholders, debt investors, suppliers, customers, etc. Often company directors will need to put these duties ahead of the scheme, which may create conflict and tension with their responsibilities to the scheme.

Following the Pensions Act 2004, many schemes have a contribution power which requires trustees to reach agreement with their employers on actuarial valuation assumptions and, combined with the requirement on trustees to take account of the employer covenant and affordability, this puts the employer at the centre of the debate on the pace of funding for schemes.

The upcoming new requirement for all schemes to have an LTO means that the triennial actuarial valuation process will not just be about the pace of funding to achieve technical provisions, but also about the TES. The employer therefore has a key role to play in determining the TES for their scheme, the pace at which that destination is reached, and the actions taken on that journey.

In this debate, it will be crucial for trustees and employers to understand the relative balance of key powers within their scheme rules. It is surprising how many trustee boards and companies have not done so to date, yet this is fundamental to developing a robust TES.

Where objectives between employers and trustees can be aligned, this is likely to achieve the greatest success in efficiently moving towards an agreed TES, but sometimes there can be a difference in views between the trustees and the employer. Advisors have a key role to play in helping to align objectives or agreeing to compromises so that an overall objective can be agreed upon.

For well-funded schemes that are very close to buyout, and without the need for further employer funding, trustees may be able to proceed with a buyout process without significant involvement of the employer. In these situations, the employer will still want to ensure the buyout process is efficient and complete. For example, it is reasonable for an employer to expect the correct benefits to be secured, to be consulted fully on how discretionary benefits are to be codified and for there to be a discussion on the allocation of post-buyout risk so that the employer retains no more legal risk than it is comfortable with.

A common approach to engagement between the employer and trustee board is linked to the triennial valuation cycle, with an employer’s focus often being on minimising cash requirements (or other priorities, such as P&L impact of any change), meaning there can be little engagement between valuations. Current legislation, to some extent, may encourage this sub-optimal behaviour.

The key for employers would be to actively engage in TES planning, taking advice to help set their TES objective. Employers should then look to build and implement the journey plan in collaboration with the trustees. The journey plan should be specific, with clear objectives, setting out an agreed remit for each party, including a definition of the advisor roles.

The employer needs to understand the risks it is running – not just financial but legal and operational. Employers need to be cognisant of current risks, for example, TPR’s power to issue contribution notices and financial support directions; and of changing regulations, such as government proposals to allow TPR to introduce a criminal offence as a sanction for “wilful or grossly reckless behaviour” of company directors.

2.8. Can Employers Benefit from the Scheme?

Where a scheme is funded in excess of the level of its buyout liabilities, the use of surplus is determined by the scheme rules. The rules setting out utilisation of surplus are varied and often significantly out of date. The one constant is that a refund of surplus to the employer (assuming this is permissible under the rules) always requires trustee agreement under statutory provisions and that power must be exercised in the best interests of the beneficiaries.

There remain many trustees and their advisers who believe that acting in the best interest of the beneficiaries in a surplus situation means that members must benefit from the surplus to some degree. This approach is too simplistic and ignores case law which emphasises the need for rules to be construed in the context of their purpose and that the reasons for surplus arising are a material factor in how surplus should be spent.

Employers would be well advised to undertake a legal review of scheme rules long before surplus arises and include rule amendments to protect their interests should a confirmed buyout surplus arise. For many schemes, there is no reason why such changes cannot be made as a part of a long-term funding package agreed as a part of triennial actuarial valuations.

Trustees of well-funded schemes also need to take care as they approach their TES not to be tempted to invest for surplus over security unless their employers are supportive of this approach and have the covenant to support it. Very few schemes have rules that would justify a unilateral attempt by the trustees to create a buyout surplus with a view to improving member benefits.

2.9. The Employer’s Financial Statements

For many employers, delivery of KPIs within published financial statements is a key corporate success measure. KPIs might include annual operating profit, earnings per share and balance sheet ratios. The way these KPIs are calculated depends on the GAAP adopted by the employer.

Unfortunately, GAAP can create tensions between quite reasonable activities trustees might take to deliver member benefit entitlements, such as reducing investment risk or purchasing bulk annuities, and the resulting adverse impact on KPIs in the employer’s published financial statements.

A perverse example (but not the only example) that sometimes occurs can be when a scheme can afford to secure all benefits with a buyout and in which scheme surplus cannot, except in extremely remote circumstances, ever revert to the employer. However, by undertaking that transaction the trustees can create a severe impact on the employer’s published financial statements.

Such tensions are typically created by the requirements of the specific GAAP not reflecting the true economic realities of the schemes. Unfortunately, the financial and actuarial factors impacting schemes are complex. Consequently, senior decision-makers, especially at non-UK multinationals, will often focus on the financial statements as the objective factor that matters.

As a result, employers may discourage trustees from reducing risk or from taking actions they would otherwise have implemented. The authors have each come across examples in which desirable activities to de-risk schemes have been deferred or even curtailed for no reason other than the potential impact on the employer’s financial statements.

2.10. The Role of Advising Actuaries

The scheme actuary is often long-standing and seen as the trusted advisor by the trustees, and therefore has a pivotal role in helping to define and navigate the path to the chosen TES. But it is important to remember where the scheme actuary role starts and ends.

A key duty of the scheme actuary appointed under section 47 of the Pensions Act 1995 and its associated regulations is to advise the trustees of all aspects of the funding position of the scheme. This includes requirements of the Pensions Act 2004, such as carrying out and certifying regular valuations of the scheme assets and liabilities and determining, together with certifying, the level of contributions that need to be paid into the scheme.

The scheme actuary or other actuary advising on TES is already required under Actuarial Standards to be aware of the current state and future evolution of a scheme and to advise their client appropriately. However, as covered below, the actuary’s role in advising on TES planning is rapidly evolving.

The actuary has a key but evolving role to play in the changing landscape. Typically actuaries have overseen the setting of the triennial valuation assumptions (whether acting on behalf of either trustees or employers) and have also been involved on the investment side, setting strategic asset allocation and other risk management areas (e.g. through member options or bespoke liability management exercises).

We envisage the future role of the actuary as pivotal in helping trustees to understand how to bring together the necessary funding, investment and covenant considerations as well as helping to point out the legal and operational considerations. In that role, the actuary would work closely with other specialist advisers. That way trustees will receive suitable advice and the full picture of their TES objective, hence delivering member benefits with the necessary degree of security whist also meeting their legal obligations to members. The challenge is the multi-disciplinary nature of the subject matter.

Actuaries should make their clients aware of the existence of legal and operational risks and explain why precision in the understanding of the scheme liabilities is important. However, actuaries should remember that they are not lawyers, covenant advisors or administrators and should include other professional advisors early in the process as required.

In an effort to ensure cost efficiency in difficult financial circumstances, many trustee boards have become accustomed to inviting some of their advisers to short segments of their meetings assigned to them. This can stifle the ability of advisers to offer valuable insights on key issues and discourages beneficial collaboration between advisers and service providers.

Only a minority of trustee boards have adviser-free time where they can do “blue sky” strategic thinking and discuss freely their views on the direction of the scheme, the employer, and their advisers.

In many schemes the actuary is the only adviser who has a clear view of such issues in the governance of the trustee board and, as the TES approaches, these weaknesses in the governance structure are likely to hinder proper deliverance of the TES. The actuary is therefore often better placed than most to encourage schemes to have a more dynamic and collaborative approach to the conduct of trustee business as well as underline the importance of adviser-free time.

Section 3: The Employer Covenant Still Matters

3.1. Introduction

The employer covenant is pivotal in the strategic direction of a scheme, providing additional capital and contingent support (see Figure 1). It can also have a significant impact on the amount of time a scheme has to realise its TES. Understanding the interaction of these factors helps develop a robust TES strategy, including what TES may not be appropriate and how quickly (or not) the scheme could be able to reach a TES.

A holistic analysis incorporating the interactions between covenant and legal, funding and investment dynamics highlights the key role of employer covenant in the strategic direction of a scheme and not just in providing financial support.

TPR’s increased focus on TES planning means looking beyond the triennial valuation cycle and focusing instead on the lasting dynamics that link the fates of the employer and its scheme. Effective integrated risk management (“IRM”) requires consideration for how both the scheme and the employer are expected to develop over the medium to long term.

To develop a TES strategy, trustees need to consider principally:

-

1. The long-term viability of the employer covenant.

-

2. The implications on the scheme of an employer covenant failure.

-

3. The downside protections are available (e.g. third-party guarantees, collateralised support).

The interaction between these items and the scheme’s funding and investment positions will help trustees determine the choice of TES and the period over which to achieve it. While trustees can rarely control when the “music stops” for the employer, they are well placed to develop a TES strategy that seeks to protect the security of member benefits along the journey.

This section examines the role of the employer covenant as:

-

1. The underwriter of investment, funding and demographic risks.

-

2. A source of additional funding for a scheme.

-

3. A key factor determining the time a scheme has available to realise its TES.

3.2. What is the Employer Covenant?

Employer covenant attempts to measure the ability of the employer to underwrite the risks and obligations of a scheme over its life.

Therefore covenant is key in the development of the TES for a scheme. The extent to which the employer can underwrite the risks inherent in the scheme and the long-term viability of the employer covenant directly influence the TES. In many instances, some TES can be ruled out by covenant considerations. For example, where a scheme is supported by a business in an industry in structural decline, a run-off investment strategy is unlikely to be appropriate.

In December 2016, TPR published its IRM guidance and identified covenant, investment and funding as the three fundamental risks, as shown by Figure 1. It defined IRM as:

“A method that brings together the identified risks the scheme and the employer face to see what relationships there are between them. It helps to prioritise them and to assess their materiality. It can take many forms but should involve an examination of the interaction between the risks and a consideration of ‘what if’ scenarios to test the scheme’s and the employer’s risk capacities.”

Figure 1. IRM relationship triangle (TPR, 2016, p.1).

It has become increasingly obvious that effective IRM requires taking a longer-term view than simply the triennial valuation cycle. The assessment needs to consider the employer’s ability to stand behind the journey towards a TES and the investment, demographic and other risks that result from the trustees’ chosen strategy.

3.3. How is Credit Risk Assessed by Commercial Lenders?

At its core, an assessment of the covenant is concerned with credit quality and capacity to absorb risks that may arise from pension obligations. Notably, the assessment must be made with respect to obligations that have a very long duration (multiple decades).

There are some parallels between an assessment of the employer covenant and assessments commonly undertaken by credit-rating agencies and banks. The appropriateness of utilising credit-ratings and historical probabilities of default (“PD”) to assess the employer covenant is examined below.

Credit rating agencies and banks tend to utilise historical default statistics and credit ratio analysis to identify companies more or less likely to default on their borrowings. As illustrated in Figure 2, the resulting PD can be low over the short term but increase substantially thereafter.

Figure 2. Cumulative probabilities of default. Source: “Moody’s Investors Service (1970-2017): Annual default study: Defaults will edge higher in 2020”.

Banks use these statistics in the context of building large lending books with several borrowers, operating across industries and geographies, and with caps on exposure to any individual or related group of borrowers. Banks also recognise that time can reduce the effectiveness of historical PD statistics in an economy that is in constant flux, which is one of the reasons they opt to set strict limits over the length of time they are prepared to lend to a company.

The employer/scheme relationship is different from most other forms of lending. An example is the high degree of concentration and idiosyncratic risk embedded in most employer covenants. Schemes have a concentrated exposure to a single employer or a small number of employers within a related corporate group. The resulting lack of diversification means that employer covenant risk is dominated by idiosyncratic risks that are unique to the individual circumstances of the employer. Statistical credit models are not intended to capture idiosyncratic risk. In fact, they largely ignore it on the assumption it is managed by holding a well-diversified credit book.

Assessing the long-term viability of an employer requires an approach that captures those characteristics that are unique to the employer. That means recognising that insolvencies can be triggered by reasons that are specific to the business rather than being driven by macro trends and that trustees are rarely in control over when the employer fails.

3.4. How is the Employer Covenant Assessed?

Covenant assessment reflects expert judgement based on relevant matters including the following:

-

1. Specifics of the employer, including financial performance.

-

2. Relevant features of the industry in which the employer operates.

-

3. Funding position and risk profile of the scheme.

-

4. Rights of the scheme under relevant legal documentation.

For example, the Pensions Employer Covenant Practitioner Working Group (2016) stated: “At a high level, assessments should enable trustees to form an objective view on the ability of the sponsoring employers to meet schemes’ demands for cash, now and in the future. A proportionate analysis should therefore include:

-

1. Identification of the legal obligations.

-

2. Consideration of the employer’s ability to generate cash.

-

3. Immediately (availability of liquid assets/finance).

-

4. In the short to medium term (trading/cash flow analysis).

-

5. In the longer term (market analysis).

-

6. In the event of distress (structural priority and/or insolvency analysis).”

To date, the output of most covenant assessments is a rating. TPR uses a four-rating scale and covenant professionals used by trustees may use scales with up to 8 or 10 ratings.

As the focus switches from the triennial valuation cycle to developing concrete TES strategies, covenant advisers will need to develop new ways to help assess long-term viability but in practice covenant visibilityFootnote 2 may be limited to the medium term for most employers. Hence, trustees need to understand the period over which assessments remain valid and developments that could materially impact the assessment, to inform the pace of the transition to the TES.

3.5. Time as a Valuable Commodity

We have already highlighted the role of the covenant to fund the scheme and to provide risk-bearing capacity to the scheme. For example, the amount of investment, funding and demographic risks borne by a scheme should be set in relation to the employer’s ability to underwrite the exposure. Should the risk(s) crystallise and a funding deficit be identified, the covenant is called to recapitalise a scheme.

Less well understood, but critical, is the role employer covenant plays in determining the time a scheme has to achieve its TES. Schemes are typically thought to have time in abundance. After all, many of the benefits held by a scheme will not fall due for decades. However, the amount of time a scheme has to reach its TES objective is intrinsically linked to the employer covenant.

In most cases, in the event of employer insolvency, a scheme would wind-up. Therefore, should the employer fail, and the scheme has insufficient resources to afford a full buyout of benefits, members will receive reduced benefits through PPF entry or a PPF+ buyout.

Given that insolvency of an employer can call time on the normal development of a scheme, this is a relevant consideration even for schemes that are not expecting additional deficit funding from the employer. That means that as funding improves, the value of the employer covenant shifts to an underwriter of tail risks and to creating the time for a scheme to realise its TES.

The issue is that companies do not tend to live forever. The lifespan of the average company is much shorter than the potential 80-year-plus lifespan of the obligations delivered by a scheme.

The UK pension framework is built on a duration mismatch, where the ultimate bearer of risk (the employer) is usually expected to be outlived by its pension promise. The likelihood of insolvency over the short term (one year) is low for the average corporation but, as illustrated in Figure 2, the risk of covenant failure increases significantly beyond the medium-term, an aspect often overlooked in the triennial valuation cycle. Black swan events, such as the current Covid situation, can lead to rapid deterioration of what may have been deemed a very solid covenant.

This duration mismatch dynamic introduces a level of uncertainty concerning the long-term viability of covenant strength – there is no one way of telling, with a high degree of certainty, how a business will perform over the time horizons relevant for most schemes. Whilst there may be some definite milestones that can be identified in exceptional cases (expiry of franchises, legal developments), broadly speaking the visibility of an employer’s prospects declines over time.

As such, there is no perfect way of assessing long-term viability and therefore covenant visibility is likely to be limited to the medium term in most cases. Ultimately, if a scheme is to rely on its employer for an extended period, a prudent approach dictates that the investment risk in a scheme’s assets that can be supported by an employer should be reduced over time.

3.6. What can Trustees do About Employer Covenant?

Whilst taking unilateral action to improve covenant strength is not usually an option for most trustees, there are actions trustees can take to better understand and mitigate key covenant risks.

Trustees can monitor covenant strength by developing an information-sharing protocol with the employer. Monitoring allows trustees to better understand the specific forward-looking risks facing an employer and to integrate these risks into the journey plan. However, management projections can be materially off the mark in a fast-changing marketplace and, as such, while monitoring can be helpful for IRM and as an input into TES planning, it has its limitations.

There are, however, three other key approaches to enhance the employer covenant:

-

1. Restructure the employer covenant. This seeks to codify legal access to value that already forms part of the covenant with a view to ring-fencing specific assets to support the scheme should the employer be unable to do so in future. This could include, for example, pledges over assets, escrow accounts and corporate guarantees.

-

2. Diversify or hedge the exposure. Earlier we noted that other lenders manage risk through diversification. Schemes also have tools to increase diversification of the covenant. This usually involves swapping exposure to employer-specific risk to other assets or businesses, for example obtaining guarantees (such as surety bonds or letters of credit) from third parties, thereby diversifying credit exposure; or covenant-driven investment strategies (such as credit default swaps or inflation protection).

-

3. Exchange the employer covenant for other forms of security. Trustees also have the option to exchange their employer covenant for other forms of covenant support as a means to increase the security of members’ benefits. These transactions include insured buyouts and superfunds and are examined in further detail in Sections 5 and 6, respectively.

Section 4: Low Dependency

4.1. Introduction

One solution to discharging the trustees’ duty to take such steps as are appropriate and reasonable to seek to pay benefit entitlements would be to simply continue paying the benefit outgo from the assets. The scheme could be wound up when the last payment has been made, or more likely at a pragmatic point before then when the assets have become small, with remaining liabilities secured with a buyout.

This approach to discharging the trustees’ duty has been known by various names including run- off, self-sufficiency, low dependence and low reliance.

These approaches are frequently compared against buyouts and schemes are encouraged to select one or the other as a TES target. However, there are significant differences in that a buyout represents a transactional event, which usually includes the scheme winding up and ceasing to exist, whereas a low-dependency solution refers to an ongoing state, and the funding and investment policies that ought to back this state, which is always going to be less clearly defined than a transaction.

This section will help trustees to clearly define a low-dependency TES by addressing:

-

1. The different approaches to defining low dependency.

-

2. How they differ and why that is important.

-

3. What influences the approach a scheme should take.

-

4. The different investment approaches to low dependency.

-

5. Other key considerations for low dependency.

4.2. What does Low Dependency Mean?

For trustees to be satisfied that they are discharging their legal obligation by continuing to run the scheme and pay pensions over the long term rather than the buyout or superfund alternatives, they will usually require a funding and investment strategy that gives confidence that the benefits will be met. As the name suggests, in this state, for the trustees to be confident of fulfilling their obligations, they will generally want to target a state that has a low dependency on the employer, to effectively remove the failure of the employer as a severe risk to members’ benefits.

The question is what level of funding and investment policy can combine to give trustees confidence that their duties are being appropriately discharged when following this approach. The challenge is there is typically a wide variety of interpretations of what this entails.

Low dependency does not represent a firm endpoint in the same way that a buyout or superfund transaction would, so it does not preclude entering one or the other of these transaction-based TES at some future point. Indeed, many schemes will take the view that low dependency is an interim step until such time as the scheme is mature enough, pricing is good enough or the employer is sufficiently aligned with a buyout approach to move ahead with that option. In this section, we propose three possible definitions of low dependency that trustees and advising actuaries could adopt and illustrate three different possible approaches to investment.

4.3. The Trustee Duty

As noted earlier there is no legal obligation placed upon trustees to target a specific approach to paying pensions. The legal obligation placed upon trustees is to take such steps as are appropriate and reasonable to seek to satisfy all benefits entitlements and, once the Pension Schemes Bill 2020 is enacted, trustees will in effect need to document their TES.

When schemes are well funded, invested in a low-risk way and have limited reliance on the employer it is generally accepted that this is an appropriate way for trustees to meet their responsibility. Risks remain, and these are discussed in this section. The issue of how much risk ought to remain within these approaches is the major question.

4.4. The Employer Perspective

There may be tactical considerations for the employer to retain the option to commit (or not) to a buyout TES in the future and hence to pursue low dependency as more of an interim solution.

The low-dependency TES is in most cases likely to be a weaker funding requirement than a full buyout. However, there are exceptions to this that are important to be aware of, especially for schemes that comprise almost exclusively pensioners.

If considering low dependency as a genuine long-term strategy the employer may want to give more careful consideration to an asset-backed funding (such as using property through a Scottish Limited Partnership) or escrow arrangement to give the trustees additional confidence in being able to fulfil the obligation in the absence of the employer.

4.5. The Historical Context

Historical common practice was to discount pensioner cashflows at a discount rate such as gilts + 0.5%, meaning that as a scheme matured the overall funding basis would tend toward this figure, which would be broadly consistent with an investment policy of investing in high-quality bonds. This approach is certainly due for an update, given schemes are maturing and seeking to make more detailed plans for their TES, and especially given the need to better integrate investment, funding and covenant considerations rather than view them as somewhat separate, as was previously the case.

TPR (2020a) makes the following comments on low dependency: “Low dependency means that funding and investment strategies are such that there is a low chance of requiring further employer support and, to the extent that such support is required, it is low relative to the size of the scheme.”

Industry surveys (Aon, 2019) (Mercer, 2020) show that approximately 40–50% of schemes are targeting low dependency as their TES, so it seems important to make progress on some form of definition, or at least a framework for one. As of today, there is no industry consensus on definitions.

4.6. Defining Low Dependency: Starting Points for a Useful Definition

Some important questions to ask when considering a definition of low dependency:

-

1. Is the definition tangible?

-

2. Is it specific enough to help decision-making?

-

3. Is it clear and unambiguous (or is it open to interpretation)?

-

4. Is it outcome-focused (or funding-focused)?

-

5. Is it prescriptive in terms of investment policy?

-

6. Is it objectively measurable?

A key question is whether, in defining low dependency, we are looking to define a funding basis, a funding basis plus an investment policy, or an overall outcome which will give rise to and could accommodate a variety of different funding bases and investment policies.

Low dependency historically has been viewed through the relatively narrow lens of funding. We would argue that we need a more rounded view, taking into account investment strategy jointly with the funding policy, in light of the covenant strength considerations of the employer and allowing for future demographic risks.

4.7. Approaches to Defining Low Dependency

In defining low dependency, we propose a range of options that fall on a continuum from “strong form” to “weak form” that actuaries may find helpful in guiding conversations.

4.8. Strong Form of Low Dependency

This could be articulated as having sufficient invested assets to pay all benefit payments with no measurable risk exposure to security prices, non-sovereign credit default risk or longevity risk. This would probably envisage 100% (or more) funded on a gilts basisFootnote 3 with assets invested in gilts and a full longevity swap.

This is a good definition, and hard to argue with, but it is so conservative as to arguably not be very helpful (potentially a stronger basis than buyout). But there will always be those who will argue for the strengthening of low dependency whilst there are any remaining risks. While this definition probably isn’t useful in practice, it is helpful to have it as a boundary case.

4.9. Probabilistic Low Dependency

Examples of this might be:

-

1. To be able to meet future pension payments within an agreed confidence level with no further recourse to the employer, for example, 95%, 97.5%, 99% etc.

-

2. The probability of paying all future pensions with no further recourse to the employer is higher than a pre-determined level, for example, 95%, 97.5%, 99% etc.

-

3. The probability of requiring any further contributions from the employer is less than a pre-determined level, for example, 5%, 2.5%, 1% etc.

This measure is most analogous to insurance solvency modelling and, of course, the probability level can be varied to reflect risk appetite.

The attraction of this measure is it wraps up funding and investment policy into a single number while leaving the exact investment policy choice open. The downside is that it will be model-dependent and assumption-dependent. Hence 95% probability in one model might be equivalent to 90% in another model. Certain models will favour particular assets and can end up embedding in views around mean reversion etc., which later may prove to have introduced risks that were not recognised.

It is quantitatively specific, which means it could be helpful for making tangible decisions and as a framework for structuring an investment strategy, but might also be considered too precise, in that trustees might be worried that they will later be held accountable as to the choice of 95% versus 97.5%, for example. An advantage is that it allows for explicit consistent evaluation of the value of financial covenant (e.g. entering a consolidation vehicle). A disadvantage is that probability does not capture shortfall – running out of money with £1bn left to pay is very different from being £1 short and this measure would not readily distinguish between the two. Therefore, trustees are likely to aim to “overshoot” rather than “undershoot” to reduce the likelihood of a shortfall.

Consequently, a variation or addition to this measure could be an expected surplus target, for example, to be invested and funded in such a way that results in a projected residual surplus of £x once all benefits have been paid, where £x is determined by the trustees. Qualitative low dependency (weak form)

An example is “To be invested and funded in such a way as to be able to meet future benefit payments with a [high/very high] degree of confidence without further recourse to the employer, taking into account key sources of risk (for example asset prices, inflation, longevity, credit etc.).”

This is probably the easiest to commit to and write down but introduces a lot of possible interpretation and semantics around the exact words used (similar to the use of the word “prudent” in the scheme-specific funding regime), and may not in practice be overly helpful in making decisions, especially when a scheme becomes better funded (although it may be helpful in setting direction if the scheme is at a low level of funding).

Overall, it is probably more helpful to have an objective that gives a more tangible endpoint than this weak form, especially once the trustees are getting close to a low-dependency state. This form of definition may nevertheless suffice earlier in the journey plan.

4.10. Key Considerations for Low Dependency

Over the next few sections, we discuss key considerations for a low-dependency framework:

-

1. Investment strategy.

-

2. Longevity risk.

-

3. Covenant strength and failure.

-

4. Scheme size and scale.

-

5. The actuarial valuation cycle.

-

6. Governance.

-

7. Member options.

-

8. Operational costs.

4.10.1. Investment strategy

There will be variations in investment strategies that can be adopted, which stems from the fact that risk can be viewed in different ways. Some might consider low risk to mean achieving a high degree of cashflow matching whereas others might view low risk as meaning minimising funding level or deficit volatility. Each is a valid risk lens but will drive different investment strategies. Therefore, an important part of choosing a TES target will be to clearly define risk at the outset.

We explain three investment approaches that are summarised by Table 1:

Table 1. Attributes of Different Low-Dependency Investment Approaches

4.10.1.1 Investing for low dependency – cashflow matching

If precise cashflow matching is a significant concern this implies an investment strategy consisting of assets that provide contractual returns to match projected benefit payments. This is often referred to as cashflow-driven investing (“CDI”).

“Low risk” in this context implies holding high-quality (low risk of default) assets with contractual return sources to ensure a high probability that the expected asset cashflows are received. It also implies largely holding assets on a buy-and-hold basis – funds in which managers can actively change the underlying holdings are unlikely to lend themselves well to a cashflow matching approach as the projected asset income then becomes less certain.

This therefore implies high allocations to gilts, liability-driven investments (“LDI”) and investment grade bonds and limited exposure to other assets or funds in a true CDI approach. In theory, the combination of matched cashflows and contractual returns means a scheme should not be a forced seller of assets and re-investment risk is significantly reduced.

Of course, being overly focused on cashflow matching may be spurious where there are other significant factors at play. For example, projected cashflows might have inherent uncertainties (for example due to exercise of member options) and some types of pension indexation are not practical to match exactly.

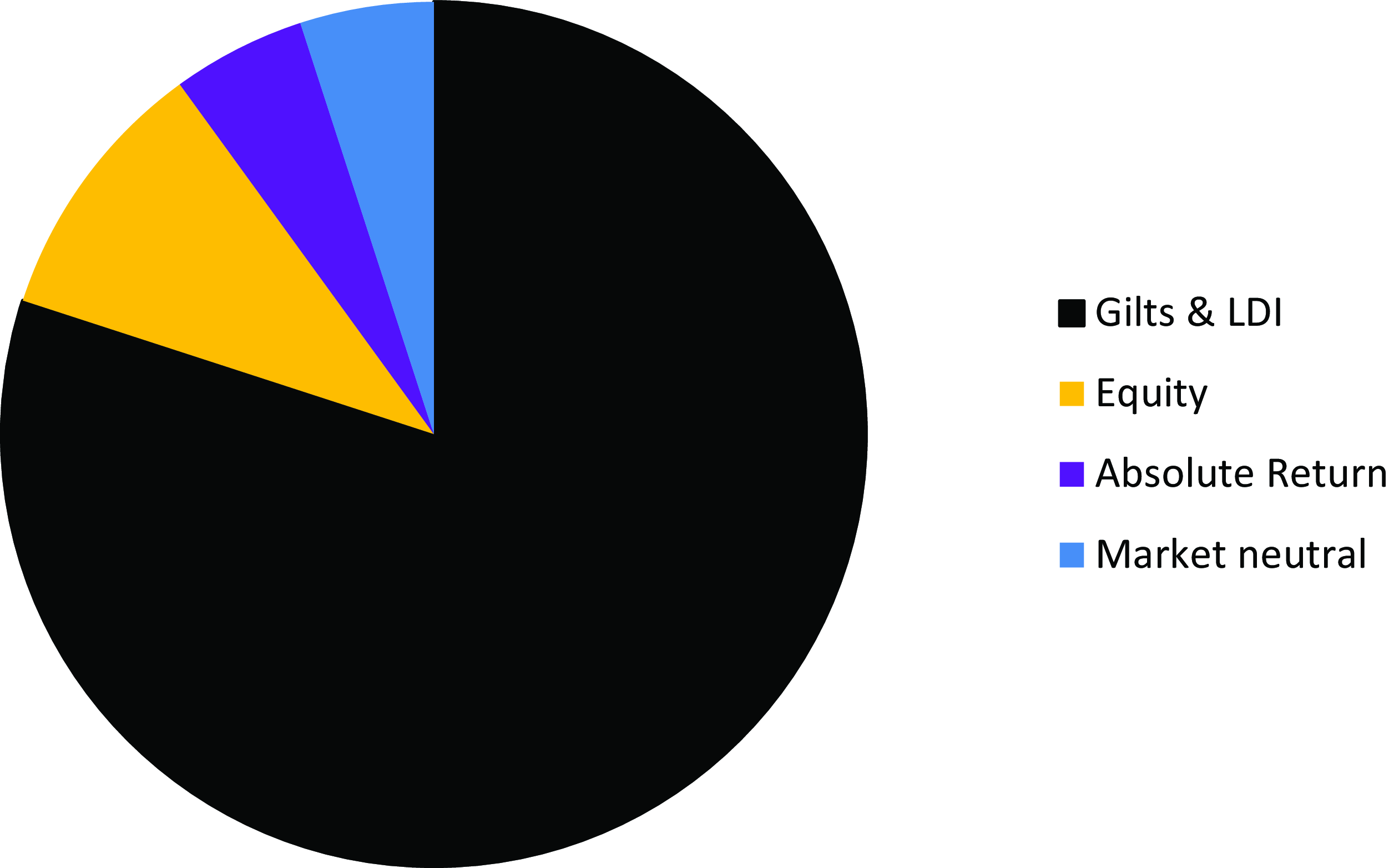

Figures 3 and 4 illustrate what a low-dependency CDI portfolio might look like. The expected return on this portfolio might be in the range of gilts+0.25% to gilts+0.5% p.a. (based on market conditions over 2019).

Figure 3. Example cashflow matched asset strategy.

Figure 4. Projected asset cashflows (over 60 years) for the example cashflow matched asset strategy.

There are a number of practical considerations that make this approach more complex than might be first thought:

-

1. Diversification: The long-dated sterling corporate bond market has significant concentration in the property and utilities sectors. Many schemes may feel they need to look overseas, particularly to the US, to build sufficient diversification.

-

2. Currency risk: When investing overseas, a cross-currency swap is needed to fix cashflows in Sterling terms. Swaps will require collateral and currency fluctuations through time will necessitate rebalancing through selling/buying of bonds.

-

3. Inflation: Most corporate bonds are not inflation-linked, and index-linked gilts are not available at all maturities. A derivative overlay can synthesise the required inflation sensitivities, but this will require collateral to back the derivative programme and is likely to mean that in practice buying, selling and rebalancing will take place.

-

4. Spread levels: The attractiveness of a CDI portfolio is linked closely to the spread levels available on the sort of bonds being considered for the portfolio. When spread levels are high, such a strategy is relatively attractive compared to alternatives. When spreads are very narrow, it could be that alternative strategies come into consideration even though they do not provide the cashflow matching characteristics of a CDI portfolio.

-

5. Reinvestment: The duration of contractual income assets is shorter than the duration of the liabilities of most schemes. Consequently, reinvestment risk may exist where there is an assumption made about future investible spreads as part of the strategy.

-

6. Funding: To better align the funding and investment policies around the overall objectives in a CDI approach the funding discount rate could be derived from the yield on the asset portfolio. This should mean that asset and liability values move in tandem from a mark- to-market perspective. The real risk to the funding position (and the overall objective) will be default risk and downgrades.

4.10.1.2 Investing for low dependency – contractual income

Alternatives to precise cashflow matching can also be suitable for low dependency and might even be preferred.

Where there is still a preference to rely on contractual returns in the TES, the investment strategy is still likely to involve allocating to high-quality (i.e. low risk of default) assets with contractual income sources, e.g. gilts, LDI and investment grade bonds.

However, relaxing the requirement to cashflow match will increase the opportunity set of assets that can be held. For example, as illustrated by Figure 5, actively managed credit funds or multi-asset credit funds and allocations to high-quality illiquid assets with contractual return sources may also be possible. Some other features of this investment approach are:

-

• The increased opportunity set should increase the expected assets compared to a CDI approach, raising it to gilts+0.5% to gilts+1% (based on market conditions over 2019).

-

• There is likely to be a wider range of assets held compared to a precise CDI approach, which may have some diversification benefits (although credit risk is still likely to be a dominant risk factor in the portfolio).

-

• The assets held may still provide a broad cashflow match.

Figure 5. Example contractual assets strategy.

As with the CDI strategy, the funding discount rate could be aligned with the yield on the asset portfolio. Re-investment risk would likely be significant under this approach.

4.10.1.3 Investing for low dependency – diversification

Where appropriate diversification is a key consideration rather than just having exposure to contractual asset returns, investment strategies that include allocations to assets that generate non-contractual returns (e.g. equities) can also be appropriate.

This will typically involve allocating a large proportion to gilts and LDI (circa 80%) to ensure overall risk in the portfolio is kept low, as shown by Figure 6. The remaining allocation is then invested in a suitable range of assets that generate contractual and non-contractual returns.

Including this allocation across a range of different asset sources will increase diversification in the investment strategy. This type of strategy, a large allocation to gilts and LDI coupled with a smaller allocation to other assets, is sometimes referred to as a barbell strategy. Some other features of this investment approach are:

-

• Expected returns on this type of portfolio are likely to be higher that holding only contractual assets, e.g. gilts+0.5% to gilts+1.5% (based on market conditions over 2019).

-

• A suitable range of both contractual and non-contractual assets will capture different risk exposures, which will have diversification benefits, in contrast to strategies that only hold contractual income assets where credit risk will dominate.

-

• While these strategies run higher levels of re-investment risk, their risk measured using deficit or funding level volatility measures is likely to be lower.

This portfolio will likely leave considerable re-investment risk on the table but it will not be as dependent on the level of credit spreads and, by being diversified, might actually result in smaller fluctuations in the funding level.

This sort of strategy might have higher expected asset returns than a pure credit-based strategy as, by “locking in” contractual returns, a credit-based strategy will typically not offer many opportunities for upside returns beyond the base yield.

On the downside, the success of this strategy will probably depend on selecting securities and strategies that increase in value, which of course is not guaranteed to happen. This strategy is likely to see periods of underperformance where the strategies do not deliver the returns expected, and this might increase cashflow risk for very mature schemes that need to liquidate a significant amount of assets each year to pay pensions.

Figure 6. Example diversified asset strategy.

4.10.2. Longevity risk

Longevity risk is another key consideration in a low-dependency TES and can sometimes represent the largest risk over the long term to benefits being paid. Over the whole-of-life run-off of a scheme, longevity uncertainty is often measured in the 10-20% impact on liabilities, depending on scheme size and confidence level modelled.

Fundamentally, there are two key approaches to managing longevity risk:

-

1. Hedging (undertaking transactions that directly remove the longevity risk, usually at a cost) such as longevity swaps, or bulk annuity buy-ins.

-

2. Reserving (an explicit reserve or allowing for a margin in investment return expectations and other assumptions to withstand a worsening of experience).

Survey data suggests that 38% of respondents planned to hedge with bulk annuities, 11% with swaps and 30% had not yet considered their hedging plans (Aon, 2019).

The preference between these two approaches is likely to be a matter of belief for most schemes, coupled with considerations around feasibility. Developing a framework around managing longevity risk in low dependency is perhaps at least as important as a framework for investing.

4.10.3. Covenant strength and failure

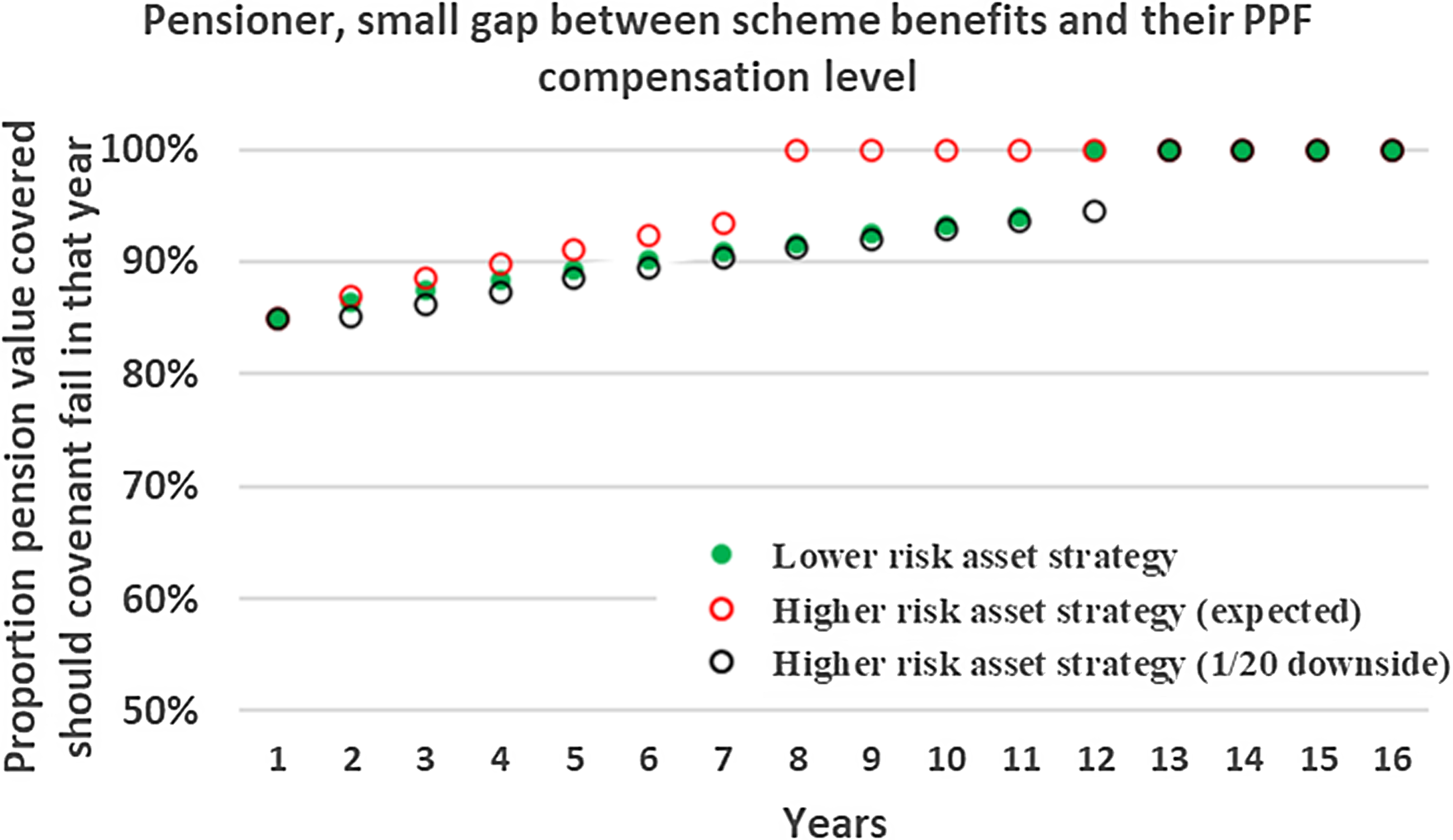

In a sense, the aim of low dependency is to no longer be reliant on the employer covenant so, in theory at least, covenant should be less relevant in low dependency than at other stages of a scheme’s journey. Given that low-dependency schemes with a stronger employer will have a better fallback in the case of the investment or funding strategy not delivering, it might be that this will influence the extent to which trustees build buffers against adverse experiences, and the question of how much risk there is overall in the low-dependency structure. For schemes with little fallback, trustees might choose to target less risk.

Ultimately low dependency is not no-risk. The trustees should ask their advisers to identify and evaluate the risks inherent in a specific low-dependency TES, including reliance and exposure to the employer. At its most basic, this could be achieved by worst-case (but still plausible) scenario analysis that tests the outcome of the following events on member outcomes:

-

1. Sponsor insolvency.

-

2. Asset shock.

-

3. Longevity events.

Specifically, regardless of the strength of the employer, future insolvency is always a possibility and unless at that time (together with insolvency recoveries) the scheme is sufficiently well funded, members will see cutbacks to their benefits. We would expect that most schemes that have achieved their low-dependency target funding level will be better funded that the PPF funding level, which means that on employer insolvency members would receive benefits of value greater than the value of PPF Compensation.

Consequently, given this continued risk of employer insolvency, where the trustees are not assured of a funding level (with recoveries) that is still expected to deliver full benefits the trustees need to address the philosophical question of whether that underlying risk to members’ benefits is appropriate. That funding level might be buyout affordability, superfund affordability or a funding level (and legal construct) that supports the scheme continuing to run as a ‘Scheme without a Substantial Sponsor’ (SWOSS). These aspects are covered in the following sections, with Section 9 focusing specifically on stressed schemes.

4.10.4. Scheme size and scale

A significant consideration around scheme size is the availability of solutions.

For many investment strategies, such as multi-class credit, diversified growth funds as well as traditional investment in equities and liability-driven-investing, pooled funds now exist that enable even small schemes to construct portfolios that deliver good risk-managed outcomes.

Precise cashflow matched portfolios by their nature will be bespoke and a detailed cashflow match will usually only be possible in a segregated managed account, which will likely only be feasible for schemes above £500m in total assets. Recently, a number of pooled building block solutions have come to the market that offer a reasonable degree of tailoring for smaller schemes.

LDI profile funds have been developed that offer a hedging profile that represents a portion of the liabilities of a typical scheme. By combining these pooled funds in a sensible way, it is possible for schemes to get a relatively close match to their liability profile.

Credit-based profile funds have come to market more recently from a variety of managers offering an approach here for smaller schemes. This is likely to continue to evolve over the coming years, however, there will remain limits on how close a match can be achieved for small schemes. For example, it would be difficult for a small scheme to put in place additional derivative overlays to generate an inflation match and to hedge any overseas bonds.

Similarly, longevity swaps are (at present) mainly bespoke transactions and currently only really make sense for schemes of perhaps half a billion pounds or larger in size.

The recent development of capital-backed journey plans, also called third-party capital solutions, is another example of an approach that is not accessible to smaller schemes. These solutions enhance the risk-bearing capacity of the covenant by providing a contingent asset that is drawn upon in specified circumstances to mitigate the impact of funding losses caused by risks such as longevity exposure and investment and hedging risks.

Entering into a master trust is one potential approach to accessing large scheme-type investment solutions for smaller schemes.

Consequently, scheme size may mean some TESs are not practical or need to be implemented differently to large schemes. Nevertheless, we would hope that with time the trend of “big scheme” solutions eventually becoming available to smaller schemes continues, so that trustees of smaller schemes are not overly constrained in their choice of TES.

4.10.5. The actuarial valuation cycle

The low-dependency state is not just about the investment strategy, but about the joint funding and investment policies that work together to deliver the member outcomes. In low dependency, the actuarial valuation becomes a vital tool.

Done well, the actuarial valuation process in a low-dependency state provides a key check on its success. A key consideration for trustees is to arrive at an actuarial approach that provides a clear picture of their funding status relative to what is necessary to fulfil their objective, while at the same time not creating excessive funding level volatility (Cowling et al., Reference Cowling, Fisher and Powe2017).

For many schemes, this could point toward an actuarial valuation methodology that looks to align the actuarial discount rate assumptions with the actual yield of the portfolio, rather than opting for the common “gilts + fixed margin” approach where that fixed margin is not dynamically adjusted to reflect anticipated returns.

This approach builds up a discount rate based on the likely returns or yields on the assets held in the portfolio less a margin. The discount rate depends on the investment approach taken and lends itself more towards the cashflow-driven or contractual-driven approaches, given that future yields for these portfolios can be estimated with more confidence (Mercer, 2016).

The dynamic discount rate changes through time in line with the asset portfolio, resulting in a smoother funded position through time and less variability in deficit-reduction contributions. The main risk driver of the funded status in this approach becomes default risk of the contractual income cashflows and so analysis is required on the deduction to make for expected defaults to the gross yield. This approach is known variously in the industry as “dynamic discount rate,” “asset-led discounting” or “cashflow-driven financing.”

Collaboration between the scheme actuary and investment adviser is essential to getting the important mechanism of the valuation working well. A key issue to address is the question of time horizon: usually the time horizon of the asset yield will be shorter than the full liability duration, leaving some uncertainty regarding the future reinvestment rate, which needs to be allowed for.

This approach of referencing the actual asset yield is not dissimilar to the approach insurers usually adopt for annuity reserving, meaning they can invest in contractual income assets that offer yields higher than risk-free whilst avoiding the solvency volatility that would have been created by adopting a relatively static “gilts + discount rate” approach. Of course, schemes have an advantage over insurers, in that they do not need to navigate capital “penalties” across different asset types, meaning that a scheme adopting a dynamic discount rate would have greater investment freedom across its low-dependency investment portfolio.

Insurers spend significant time in seeking to match cashflows and reduce reinvestment risk. So, although insurers may have appeared to have successfully tackled the dynamic discount rate question, that does come at the cost of not immaterial sophistication, complexity and operations.

The use of such a dynamic discount rate will remove funding volatility that is arguably artificial in nature, and is largely a consequence of the actuarial methodology adopted, and will become increasingly relevant for schemes with a low-dependency TES that adopt asset strategies that more closely address matching of assets and cashflow liabilities.

4.10.6. Governance

A low-dependency scheme may be quite different from a scheme earlier in its life cycle. Different skills and expertise will be needed around the trustee table, for example, the prominence of longevity, credit-based strategies and so on means some experience in those areas is desirable. Also, specific trustee committees might be set up to oversee the aspects critical to delivery of the TES.

The investment, actuarial and covenant advisers will have to work incredibly closely together so it may make sense to revisit appointments to ensure the setup remains appropriate. The employer would need to be involved in a constructive way and understand the strategy.

If an employer does become insolvent during a low-dependency strategy, then advice around wind-up would be needed quickly so that the trustees can understand the options and make effective choices. Indeed, pre-planning through scenario testing for employer insolvency may be highly desirable so that trustees can ensure that their scheme is robust with the right rules and powers to cope in such circumstances and that the trustees are able to act swiftly and decisively.

4.10.7. Member options